Перевод денег

Trading kan u blootstellen aan risico op verlies groter dan uw stortingen en is alleen geschikt voor ervaren klanten die voldoende financiële middelen hebben om dergelijk risico te dragen https://renaultra.ru/wp-content/pages/ts-upis-ligha-stavok-kak-vyviesti-dien-ghi-bystro-i-biez-oshibok.html. Geen enkele informatie op deze site is beleggingsadvies of een uitnodiging tot het kopen of verkopen van enig financieel instrument.

Discipline and mental fortitude are key in addition to knowledge and experience. You need discipline because you’re most often better off sticking to your trading strategy should you face challenges. Small losses can turn into huge ones without this.

You must also specify the time in force when you’re placing your order. This is how long it’s active. This table provides the most common options, along with their abbreviations, that are offered by the best online brokers:

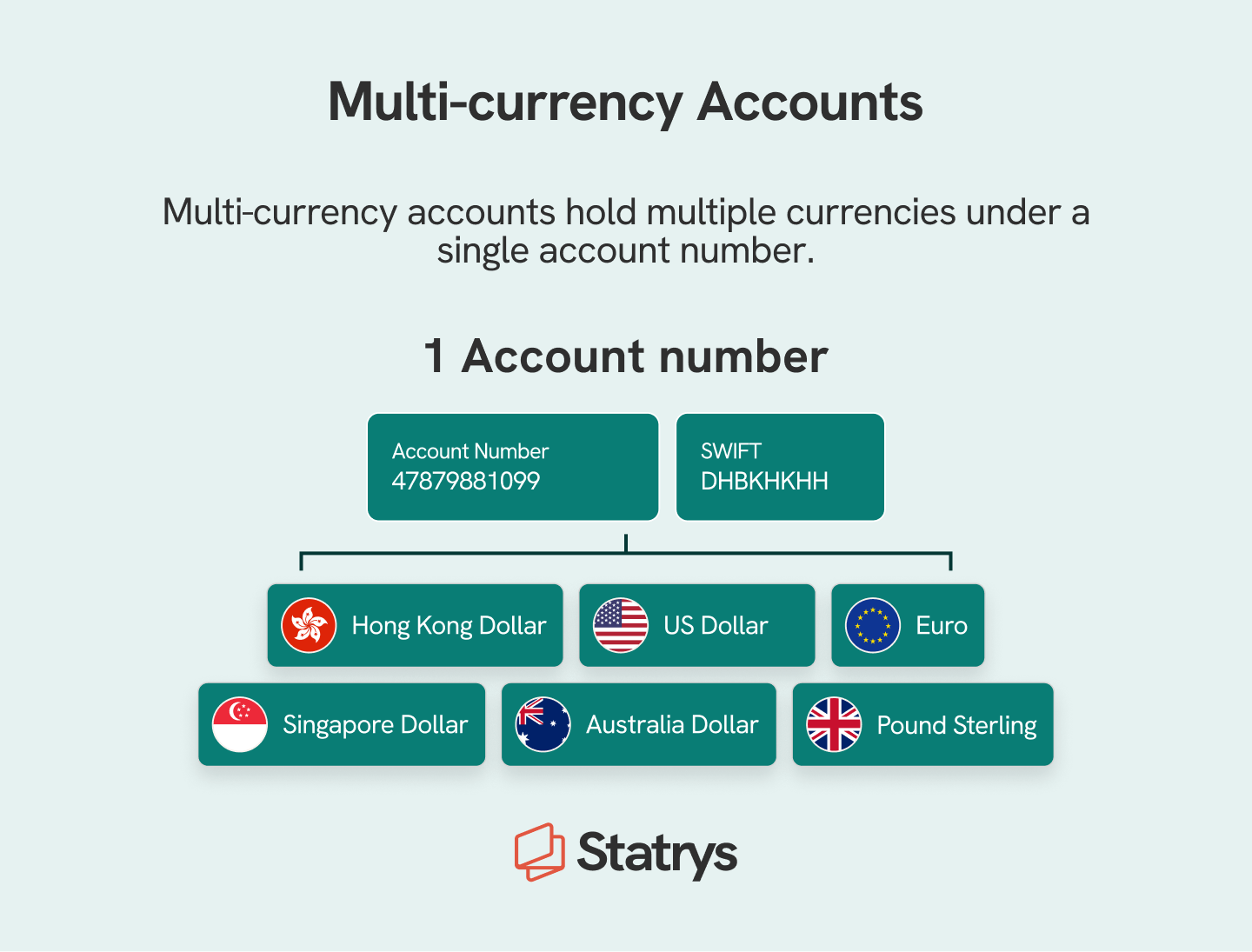

Multi-currency trading account

4.50%*Current promotional rate; annual percentage yield (variable) is 4.00% as of 12/27/24, plus a .50% boost available as a special offer with qualifying deposit. Terms apply; if the base APY increases or decreases, you’ll get the .50% boost on the updated rate. Cash Reserve is only available to clients of Betterment LLC, which is not a bank; cash transfers to program banks (www.betterment.com/cash-portfolio) conducted through clients’ brokerage accounts at Betterment Securities. FDIC insurance is subject to certain conditions.

This website does not constitute financial advice.All investments carry a degree of risk: learn more.Swissquote Bank Europe Supervised in Luxembourg by the CSSF.Member of FGDL Deposit Guarantee Scheme.

Yes, when placing an order, you can select between your primary currency and the asset’s currency. Pay no FX fees on your trades by selecting the asset’s currency. You can also set the default currency for your orders in Menu➡Settings➡Currency options.

Revolut’s account offers a transparent fee structure and the ability to hold and send more than 30 different currencies. There is no fee to change currency up to £1,000 on weekdays (on its free Standard account) and a 1% charge is applied at weekends.

Yes, you can deposit funds in any of the supported currencies. This flexibility allows you to have more control over your account management and trading activity and can help you avoid potential conversion charges from your bank.

Investment portfolio management

There are 4 main types of Portfolio Management. Active management involves a manager actively buying and selling assets to try to outperform benchmarks. Passive management tracks a market index with minimal trading. Discretionary management involves the manager having authority to make investment decisions on behalf of clients. Non-discretionary management involves the manager making recommendations but the client retains decision authority.

This is known as behavioural investing, and it’s often where people slip up. The majority of investment gains are dampened by a degree of investor error, and generally the less decisions you can make, the better.

A conservative portfolio focuses on capital preservation and stability over returns. It holds primarily low-risk fixed income assets like high-quality bonds, cash equivalents, and money market funds. The equity allocation is minimal, between 0-20% in dividend-paying large-cap stocks and low-beta sectors like consumer staples and utilities.

Tax-efficient portfolios aim to optimise after-tax returns by minimising unnecessary taxes paid. Interest, dividends, and realised capital gains are subject to taxes, reducing investor net returns. Key tax-efficient strategies include using tax-advantaged accounts, holding assets for longer durations, harvesting losses to offset gains, investing in assets with favourable tax treatment like municipal bonds, and avoiding excessive trading.

Portfolio managers take advantage of opportunities in different market segments and hedge risks through prudent diversification. Leveraging portfolio optimization models and risk analytics helps create robust portfolios resilient to market turbulence. Portfolio management applies discipline to investing by linking investments directly to an individual’s objectives, time horizon and risk tolerance. Ongoing portfolio management is essential for investors to meet their long-term financial targets in the face of dynamic market conditions.

Income-oriented portfolios focus on generating regular income for investors who rely on portfolio withdrawals to meet living expenses. They emphasise fixed income assets with consistent interest or dividend payouts like bonds, REITs, MLPs, preferred stocks, and high-yield stocks. Riskier growth investments take a smaller share.

Najnowsze komentarze